Early Access Rights

Exclusive Soft Launch Invitations

3-day Early Access Before Public Release

Perfect Waves for Every Skill Level, Every Time

At the heart of Peak Surf Park is Surf Lakes’ 360-degree technology—offering a truly unique “Four Parks in One” experience.

This innovation creates multiple types of waves simultaneously, allowing surfers of all abilities to enjoy the perfect wave without overcrowding or wait times.

Peak will host epic competitions, from club surf, to high school teams, to professional events. Families can cheer from vibrant beachside venues, while kids dream big in a sport that’s about to explode.

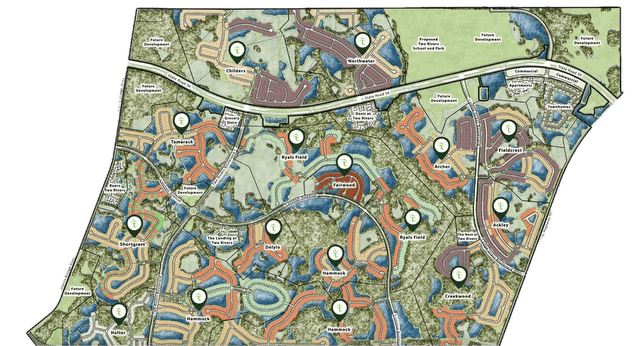

Check Out Our Fantastic Location

Two Rivers stands as an impressive 5,500-acre master-planned community featuring 7,400 residential homes, over 3 million square feet of retail space, and a brand-new K-8 school. Within this thriving development, Peak's strategic 35-acre site sits conveniently off SR 56, offering prime positioning to capitalize on the area's exceptional growth potential and superior accessibility.

Our expert team brings together expertise in development, finance, and recreation to make Peak Surf Park a reality. With Surf Lakes technology, we provide the best surf experience in the world.

Peak Surf Park

Founder

Surf Lakes

Surf Technology Partner

Thinking Adrenaline

Development & Ops Advisor

Thinking Adrenaline

Development & Ops Advisor

JLL

Capital Advisor

Engineering Design Partner

Scantec

Shumaker

Legal Partner

Peak Surf Park

Marketing Advisor

Peak Surf Park

Accounting

Invest in Peak Surf Park with a minimum investment of $750

Located in Tampa Bay, drawing from 26.7M tourists and 5M locals annually.

Balanced income from surf activities, dining, retail, and events.

35 acres in the booming Two Rivers community, with land-backed investment options.

Cutting-edge Surf Lakes tech supports 200 surfers/hour, attracting all skill levels.

Proven team with expertise in recreation, real estate, and finance.

Regulation CF allows investors to invest in startups and early-growth companies. This is different from helping a company raise money on Kickstarter; with Regulation CF Offerings, you aren't buying products or merchandise - you are buying a piece of a company and helping it grow.

Accredited investors can invest as much as they want. But if you are NOT an accredited investor, your investment limit depends on either your annual income or net worth, whichever is greater. If the number is less than $124,000, you can only invest 5% of it. If both are greater than $124,000 then your investment limit is 10%.

To calculate your net worth, just add up all of your assets and subtract all of your liabilities (excluding the value of the person's primary residence). The resulting sum is your net worth.

We cannot give tax advice, and we encourage you to talk with your accountant or tax advisor before making an investment.

Individuals over 18 years of age can invest.

There will always be some risk involved when investing in a startup or small business. And the earlier you get in the more risk that is usually present. If a young company goes out of business, your ownership interest could lose all value. You may have limited voting power to direct the company due to dilution over time. You may also have to wait about five to seven years (if ever) for an exit via acquisition, IPO, etc. Because early-stage companies are still in the process of perfecting their products, services, and business model, nothing is guaranteed. That's why startups should only be part of a more balanced, overall investment portfolio.

The Common Stock (the "Shares") of Charging Grom LLC (the "Company") are not publicly-traded. As a result, the shares cannot be easily traded or sold. As an investor in a private company, you typically look to receive a return on your investment under the following scenarios: The Company gets acquired by another company. The Company goes public (makes an initial public offering). In those instances, you receive your pro-rata share of the distributions that occur, in the case of acquisition, or you can sell your shares on an exchange. These are both considered long-term exits, taking approximately 5-10 years (and often longer) to see the possibility for an exit. It can sometimes take years to build companies. Sometimes there will not be any return, as a result of business failure.

Shares sold via Regulation Crowdfunding offerings have a one-year lockup period before those shares can be sold under certain conditions. The exceptions are sales to:

(i) to the Company;

(ii) to an "accredited investor" within the meaning of Rule 501 of Regulation D under the Securities Act;

(iii) as part of an offering registered under the Securities Act with the SEC; or

(iv) to a member of the Investor's family or the equivalent, to a trust controlled by the Investor, to a trust created for the benefit of a member of the family of the Investor or equivalent, or in connection with the death or divorce of the Investor or other similar circumstance.

In the event of death, divorce, or similar circumstance, shares can be transferred to:

The company that issued the securities

An accredited investor

A family member (child, stepchild, grandchild, parent, stepparent, grandparent, spouse or equivalent, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law, or sister-in-law, including adoptive relationships)

If a company does not reach their minimum funding target, all funds will be returned to the investors after the close of the offering.

All available disclosure information can be found on the landing pages for our Regulation Crowdfunding offering.

You can cancel your investment at any time, for any reason, until 48 hours prior to a closing occurring. If you've already funded your investment and your funds are in escrow, your funds will be promptly refunded to you upon cancellation. To submit a request to cancel your investment please email: info@dealmakersecurities.com

At a minimum, the company will be filing with the SEC and posting on its website an annual report, along with certified financial statements. Those should be available 120 days after the fiscal year end. If the company meets a reporting exception, or eventually has to file more reported information to the SEC, the reporting described above may end. If these reports end, you may not continually have current financial information about the company.

DealMaker Securities is serving as the intermediary for this offering. Once an offering ends, there is no guarantee that DealMaker Securities will have a relationship with the company. The company may continue its relationship with DealMaker Securities for additional offerings in the future. DealMaker Securities' affiliates may also provide ongoing services to the company. There is no guarantee any services will continue after the offering ends.

The share price is $1.00 for every share of common stock. The minimum investment is $750.38, which includes a 3.5% processing fee. Perks will be determined by your investment level. You will receive a subscription agreement with all investment information once you invest.

Anyone can invest in this Reg CF round. You don’t need to be an accredited investor to invest in this offering. If you are an accredited investor (a net worth of $1 million or more not including the value of your home or annual salary of $200,000 individual / $300,000 family), we do have a Reg D offering available to consider.

If and when distributions of profits are made, investors will receive their pro rata return based on their total number of shares.

Investors could have opportunities to sell their shares if the company goes public, a strategic investor offers to buy out existing shareholders, or the company offers to buy out existing shareholders.

Every purchase of equity shares comes with some level of risk. Investing in Peak Surf Park should be considered a high risk investment with the possibility of losing part or all of your investment. You should not invest any money you can’t afford to lose.

We anticipate this offering to close in 3 months. However, the round could be fully subscribed and then closed at any time

We have 4 quadrants of surf. A north, east, south, and west peak. While the surf lake could handle well over 200 surfers per hour in total, Peak will be programmed each quadrant to run 32 surfers on peak wave and 16 beginners in the white water for a total of 48 surfers per quadrant. So the whole surf lake would have 196 surfers total if full. Every surfer will get at least 10 rides per hour and have plenty of room in the lake to enjoy themselves.

People who have tried all of the different technologies comment that the Surf Lakes model is the most ocean-like wave. That is because the wave comes from a deep 35 foot well up to shallow water and is formed in the same way, with the same energy as an ocean break. The wave can also be pushed to 9 feet high at its upper level. The take off zone mimics the ocean where you line up and see the wave coming at you versus coming out of a wall next to you. And you never surf toward a wall, which is common to most of the surf technologies. Surf Lakes just doesn’t have any walls… like the ocean.

People are familiar with some of the flat water lagoons in the region. They have no waves, thus no surfing. They are typically half the size and are much more comparable to a large pool, rather than a surf park.

Surf Lakes is the only technology that spent over 4 years testing their technology with a full scale prototype. Thousands of people have experienced and rave about the wave quality. The technology has been designed and tested with multiple levels of redundancy.No other surf tech built a full scale prototype and engaged in the intense research that Surf Lakes has completed over the last 5 years.

It is tough to be definitive with a project of this scale, but we are on target for a soft opening in late 2027.

All of our models have been using a $70 per hour average price. However, hourly surfing, memberships, day passes, etc. will fluctuate in terms of total surf cost. Pricing will also vary based on skill level selected, time of week, and other factors. The goal is to make Peak an affordable experience that delivers far more value than the cost of admission.

Yes there will. The levels of membership have not been determined yet, but should include a range of options for you to find the right fit.

Water parks have been delivering clean water for many many years. There are many ways to ensure proper water quality. Peak will employ a three tiered system that will deliver clear, clean, and safer water.

Safety is paramount at Peak and there will be a robust safety plan for every component of the park. There will be an underwater net around the central wave device. There will be surf marshalls at the take off zones monitoring the line up. There will be trained lifeguards and other personnel monitoring the water zones at all times. The same intensity of safety will be pursued in and out of the water to ensure the safety of our guests at all times.

The annual water consumption of the surf lake will be equivalent to that of 2-3 holes on a typical golf course, minus the fertilizer run off. The surf technology itself will be one of the most efficient in the market place in terms of power used per surf wave ridden. That is because one pulse of the Central Wave Device will allow 24 surfers to catch a wave! For most other surf parks, each time they run their wave machine, only 1 or 2 surfers catch a wave. Peak will also take steps to minimize our water and power footprint wherever possible including alternative water and fuel sources.

12 acres

At the take off zone, the lagoon will be 8-10 feet deep. The lake will gradually come to grade as you move toward the edges of the lake.

Reinforced concrete with softer materials on top at potential impact zones.

Like every developer in Florida that has to go underground. We will employ a series of techniques common to construction projects to dewater and anchor down the surf lake. None of those techniques will be unique to our project. We will partner with a GC that has a very strong track record in civil infrastructure projects and experience in providing the necessary construction solutions for the Florida market.

First, technology has improved dramatically over the last 15 years since the Ron Jon effort failed. Second, the Surf Lakes model allows for far more surfer throughput than other technologies, which means the pro forma still pencils despite the higher costs of construction in Florida environments.

Regulation CF allows investors to invest in startups and early-growth companies. This is different from helping a company raise money on Kickstarter; with Regulation CF Offerings, you arenʼt buying products or merchandise - you are buying a piece of a company and helping it grow.

Accredited investors can invest as much as they want. But if you are NOT an accredited investor, your investment limit depends on either your annual income or net worth, whichever is greater. If the number is less than $124,000, you can only invest 5% of it. If both are greater than $124,000 then your investment limit is 10%.

To calculate your net worth, just add up all of your assets and subtract all of your liabilities (excluding the value of the personʼs primary residence). The resulting sum is your net worth.

We cannot give tax advice, and we encourage you to talk with your accountant or tax advisor before making an investment.

Individuals over 18 years of age can invest.

You can cancel your investment at any time, for any reason, until 48 hours prior to a closing occurring. If youʼve already funded your investment and your funds are in escrow, your funds will be promptly refunded to you upon cancellation. To submit a request to cancel your investment please email: info@dealmakersecurities.com

There will always be some risk involved when investing in a startup or small business. And the earlier you get in the more risk that is usually present. If a young company goes out of business, your ownership interest could lose all value. You may have limited voting power to direct the company due to dilution over time. You may also have to wait about five to seven years (if ever) for an exit via acquisition, IPO, etc. Because early-stage companies are still in the process of perfecting their products, services, and business model, nothing is guaranteed. Thatʼs why startups should only be part of a more balanced, overall investment portfolio.

The Common Stock (the "Shares") of Charging Grom LLC (the "Company") are not publicly-traded. As a result, the shares cannot be easily traded or sold. As an investor in a private company, you typically look to receive a return on your investment under the following scenarios: The Company gets acquired by another company. The Company goes public (makes an initial public offering). In those instances, you receive your pro-rata share of the distributions that occur, in the case of acquisition, or you can sell your shares on an exchange. These are both considered long-term exits, taking approximately 510 years (and often longer) to see the possibility for an exit. It can sometimes take years to build companies. Sometimes there will not be any return, as a result of business failure.

Shares sold via Regulation Crowdfunding offerings have a one-year lockup period before those shares can be sold under certain conditions. The exceptions are sales to:

(i) to the Company;

(ii) to an “accredited investorˮ within the meaning of Rule 501 of Regulation D under the Securities Act;

(iii) as part of an offering registered under the Securities Act with the SEC; or

(iv) to a member of the Investorʼs family or the equivalent, to a trust controlled by the Investor, to a trust created for the benefit of a member of the family of the Investor or equivalent, or in connection with the death or divorce of the Investor or other similar circumstance.

In the event of death, divorce, or similar circumstance, shares can be transferred to:

● The company that issued the securities

● An accredited investor

● A family member (child, stepchild, grandchild, parent, stepparent, grandparent, spouse or equivalent, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law, or sister-in-law, including adoptive relationships)

All available disclosure information can be found on the landing pages for our Regulation Crowdfunding offering.

At a minimum, the company will be filing with the SEC and posting on itʼs website an annual report, along with certified financial statements. Those should be available 120 days after the fiscal year end. If the company meets a reporting exception, or eventually has to file more reported information to the SEC, the reporting described above may end. If these reports end, you may not continually have current financial information about the company.

DealMaker Securities is serving as the intermediary for this offering. Once an offering ends, there is no guarantee that DealMaker Securities will have a relationship with the company. The company may continue its relationship with DealMaker Securities for additional offerings in the future. DealMaker Securitiesʼ affiliates may also provide ongoing services to the company. There is no guarantee any services will continue after the offering ends.